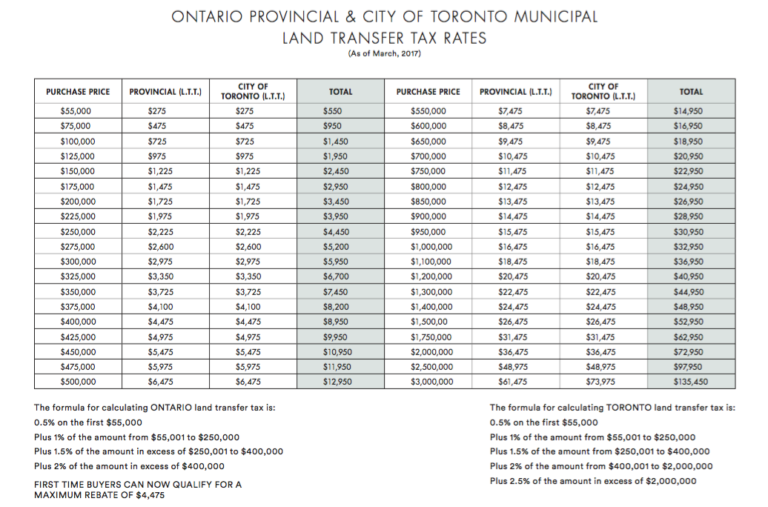

As of January 1st, 2017 Ontario has doubled the land transfer tax rebate for first time home buyers from $2,000 to $4,000. That means first time home buyers wont pay provincial tax on homes sold for $368,000 or less. This is great news for buyers who are looking to buy condominiums or are looking outside of the city, but those looking to purchase home in the city, you will still have to pay about 2% tax on a purchase price between $400,000-$2,000,000. With the average selling price being over $700,000 most likely there is still provincial tax to be paid. This is still great news, saving $4,000 is a lot! The city of Toronto has had a rebate for first time home buyers for many years which is set at a maximum of $3,725 (covers the Toronto land transfer tax on a purchase of $400,000 or less). If you purchased a home for $400,000 you would have negligible tax to pay. On a home worth $1 million dollars, you would be looking at paying $24,274 in land transfer tax, a savings of $7,725.

The City of Toronto has approved changes to the Toronto Land Transfer Tax that mean additional Toronto Land Transfer Tax costs for some home buyers with a closing date on or after March 1, 2017, when it will be harmonized with the provincial LTT.

• Added an additional LTT of 0.5% of the value of a residential or non- residential property from $250,000 to $400,000 (an additional $750)

• Added an additional LTT of 0.5% of the value of a residential property above $2 million

• Added an additional LTT of 0.5% of the value above $400,000 of a non- residential property

• Increasing the maximum allowed First-Time Home Buyer Rebate to $4,475, up from $3,725

• Amended the first-time home buyer rebate program eligibility rules to restrict rebate eligibility to Canadian citizens or permanent residents of Canada

Download the table here